It's all about Timing

Forward Stock Split on Shares And Reverse Splits

One of the Major reasons that people believe that a Reverse Split makes a stock go down is Timing and just when the companies do it. There is A LOT more to it than just simply Adjusting the Number of shares.

The Big thing Reverse Splits accomplish is they Clean up companies from Noteholders who want to sell either way. They dont care if they sell at .0003 or at .73 after a Split either way they are selling.

The stock is only worth what its worth.. It will go up or down either way just splits Forward or Reverse have perks. They are a way for companies to take control of their shares and Increase their value over time!

With companies like APRU that have Large amounts of Convertible debt it is going to hurt a lot less if we can get them out around a Split instead of now They could Crash APRU to No Market and hold it down in the Dumps with no action for Years unless Changes are made at the right times which Protects the Company as much as possible.

This is a VERY Good Article on Reverse Splits.

http://www.essortment.com/financial-definitions-stock-splits-reverse-stock-splits-52101.html

As Message Boards get all Crazy one must Chuckle

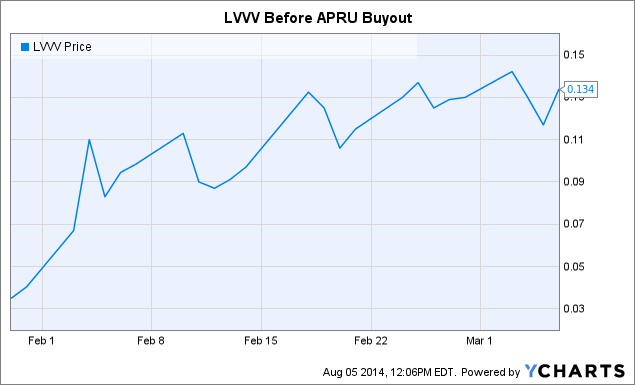

Here is a Chart of LVVV Before the APRU Takeover

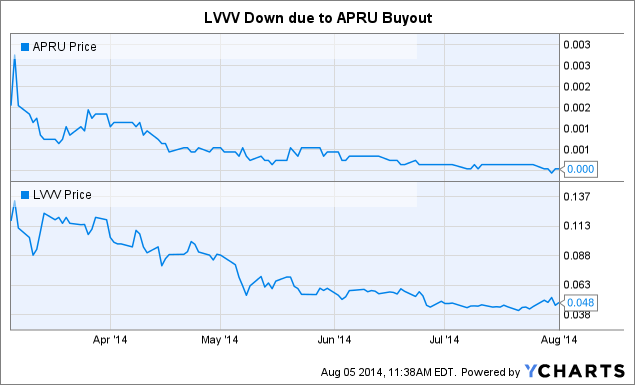

Here is a Chart of LVVV After the Takeover.

APRU is just Floating Shell till it's Salvaged

Since they are Connected I am 100% behind both Stocks. One of the only Problems is the Actual Value of APRU and Including the $5 Million in Super Preferred Shares it Hands APRU a Market Value of Nearly $12 Million or Nearly 200% the Price of the Parent Company... Crazy talk not only that were dealing with a Shell that Bill paid less than $400k for.

Between 50 million APRU shares Dumped at .0001 and .0002 and Odd trades Buying Just .38 cents of stock in a Purchase it is Obvious there is MUCH to shake out over there... There is A billion shares from past debtors that will weigh on the stock and it is a Market Makers Playground as the Buy at .0001 and slowly make 200% on Pumps and Mislead Investors.

Its not a Question of IF a Reverse Split with APRU its a Question of when... We know thats a Timing thing and will be when they can shake out the Optimum number of shares Before and After the Split... It really makes no difference if APRU falls Before or After the Coming Reverse Split either way is Good for LVVV

Livewire paid only .000026 or so for APRU Bill knows that APRY was not worth .003 or even .0003 if it was Livewire wouldent have paid so little

Fact is Livewire Paid just under $400,000 for 77% or APRU & has a $5 Million dollar Note from APRU due upon demand as well.

The share price today reflects LVVV paid about 94% less for 77% of the Company There is No need to sit around and try and Prop up a share price like this..

APRU Printed over 16 Billion extra shares for Livewire and there is No need to Misrepresent their Value here No way those shares are worth any more than $1 Million Flat out The Note is Worth MAYBE a Extra $500,000 Hopefully once Dilution hits so 1.5 mil off of $400k is not to shabby.

Once APRU reaches a Fair Value it will be nice to see growth there As it is now they cannot even Accept payment without using Livewires accounts. There is MUCH work to do there and as it is done we should see value added to both stocks however trying to overvalue APRU is Not smart for Investors.

As it is Now The Stock that LVVV owns in APRU is worth almost 2 Times the Market value of LVVV.. The sooner things fall in line the better.

A reverse Split will not happen at APRU till the Timing is right. They must shake out as much Old Debt Before And After the Split as possible. I am Confident they Will Time it as needed... This is likely one of the reasons Why we see no sales through APRU and its all being sent through LVVV... APRU is just a Floating shell for now... Over time it will get some PR's here and there and there will be pumps and all sorts of fun stuff meanwhile...

Its Important to remember LVVV only gave up about $400k for the APRU and RSHN Investments and it is NOT too much cost considering all. It should be interesting... However the Faster APRU gets to a Real Value and not a Pumped inflated value the better... Just Real Products Real Sales and True Increases in Assets are needed here & there.

Shell Company Issue Shares Reverse Split Merger Buyout A/S O/S Video

Here is what the SEC says about Reverse Splits.

A Overvalued Asset helps LVVV none!

To boot No one is fooled by a incorrect value. Even If all the internal work is done at LVVV and APRU is done for this Quarter on the Buyout and we get to see it... Still APRU would be Overvalued to closing of that quarter which is Much higher than it should be.

People will read the reports and check it out they will know. And along those lines its Obvious APRU is Overvalued by far since the parent is worth like 40% less even with its assets taken into account.

If this was actual value than

16 Billion Shares of APRU = about 5 Million + $5 Million Super Preferred

WOW LVVV would own More APRU stock than the Entire Market Cap of EITHER Company... It will all level out and be taken into account it will just be a Much Smoother process at a Share price that does not cause panic with each and every trade.

It does not really matter if APRU Falls in this side or that side of a Reverse Split or After the Reverse Split. The Dilution is coming when the New Debt is Unlocked in the coming months and as we can see the old debt is Unloading at .0001 and .0002 as fast as possible.

A reverse Split will allow Companies & Investors to Buy or sell without Pushing the Stock Up or Down by 33% to 50% over Trades that do not and should not effect the stock....

What was it today on the first APRU trade a 1266 buy at a total investment of .38 cents WOW they only have to make 31 times their investment to make Money there.... Come on....

RSS Feed

RSS Feed